The Mechanics of the Curiosumé DApp are extremely simple. In fact, perhaps the greatest challenge of building the application will be to truncate the features of Curiosumé to the simplest functional form.

Means and Methods of the Curiosumé DApp

The only thing that Curiosumé is really supposed to accomplish is convert a résumé, CV, or project description from an analog form to a digital form so that the accounting, production, storage, and exchange of intangible assets can be machine enabled in a meaningful and valuable way. Centralized applications such as Facebook and Google perform this job quite effectively within their fortress for sale to 3rd parties, Curiosumé will do the same for decentralized applications between two parties only where value is retained by the creators and owners of the data.

An analog to digital converter for knowledge assets.

Curiosumé is a “writer” that is given away free to the Commons, open sourced, and decentralized. Ideally, an independent instance of the totality of Curiosumé could reside on every device. Applications that import Curiosumé data are called “readers”. Readers will be developed by entrepreneurs to accelerate any number of business models that are otherwise unviable in the current economic paradigm or simply under-performing due to the friction of the current economic model. Reader application may be for-profit giving the network an incentive to maintain Curiosumé. How an entrepreneur uses Curiosumé could be a trade secret rendering many patents obsolete. These Reader Applications may include Decentralization schemes (DApps), P2P exchanges, and community cooperatives.

As such, the preferred interface between the reader and the writer will be likely be more suited to the MaidSafe protocol of secure P2P exchange of data. This would be similar to other intangible assets such as music, art, and literary works. It is easy to imagine a persona of one’s life story to be a real-time literary work – if not, then it should be.

Converting knowledge assets from analog to digital form:

Step one: User tags themselves with URL’s from Wikipedia articles that best represent intentions to interact with their community.

Step two: User self-selects their placement on a spectrum comprised of endpoints: student of that content, and teacher of that content (Note; midway across the spectrum corresponds to degrees of collaboration).

Step three: Curiosumé creates a digital persona in a specific form

Step four: Export persona to “reader” applications for analysis and processing.

This is the extent of the functional requirements of Curiosumé.

Operational Requirements:

The operational requirements of the application are somewhat more complex. The following six conditions must me secured by the Curiosumé application. If any of these 6 tenets are compromised, the mathematics behind the applications will fail and the intended outcomes will be suboptimal.

1. All public and private Wikis should reconcile upward to a top level Wikipedia entry

2, Rankings must span a non-competitive “student-collaborator-teacher” spectrum

3. Users must be allowed to self-select their placement on the spectrum.

4. The data format must be uniform as;

5. Persona must be indelible to anyone except the owner.

6. Interactions must be anonymous until the point of transaction

These 6 Tenets are unpacked a bit more below:

The Calculus of Curiosumé

In this form, clean data may be easily normalized for statistical inference while remaining anonymous until an actual transaction of personal data may be negotiated on a P2P basis. In essence, the criteria described here will produce extraordinarily useful data.

Rule 1: This rule secures a commons based knowledge inventory. Much like air, water, and Earth, the knowledge assets in the commons are visible components from which useful things will be produced as regulated by supply and demand for the same components.

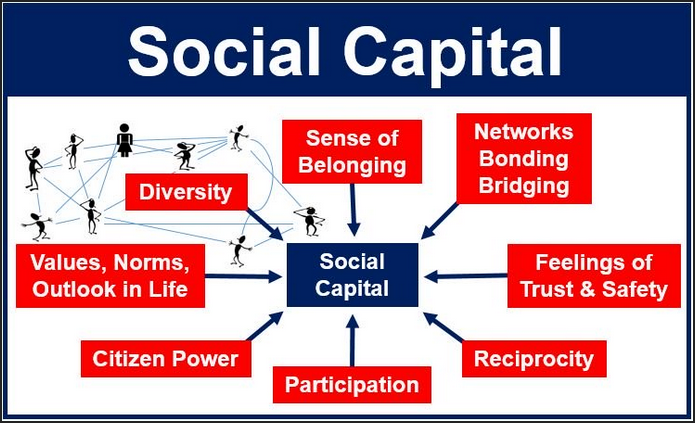

Rule 2: Students and teachers do not normally compete, rather, in the case of Curiosumé DApp, they represent “supply” and “demand” in a proto-economy. Collaborators represent factors of production in an economy where complementary knowledge can replicate a iterate – these are the engines that create value – this is the mining function. These data will form a bell curve providing statistical inference to the commons where social value is mined in aggregate.

Rule 3: The process of self-selection will be deeply personal to all participants and represents the individual mining of value for deposit in the new bank of intangible assets. All this “mining” can be measured to form the basis of generalized reciprocity of social crypto-currencies.

Rule 4: The common format of of the Curiosumé output function will assure the ability to mix, match, exchange, discover, or test any scenario of social production imaginable.

Rule 5: Gives each person ownership of their data.

Rule 6: Not unlike Craigslist, anonymity until point of transaction is important for allowing people to view the public dataset and test their own participation to find opportunities for productive interaction.

Reader DApps:

When a match is made, a transaction can be negotiated. However, this functionality is beyond the scope of the Curiosumé writer. Instead, an innumerable amount of Readers will be developed by entrepreneurs to collect, form, and test scenarios negotiating the decentralized production of all useful things.

Innumerable use cases will create moderate generalized disruption across the current economic paradigm until a tipping point is reached where factors of production will flip from finite tangible to infinite intangible basis of account. Social priorities regarding what is invented and produced will be altered in favor of shared asset preservation rather than private asset consumption. Income equality, by design, will be normalized. Collaboration will replace competition eliminating the need for over reaching controls and associated force.