There is no shortage of entrepreneurs in this world.

6 Billion of them wander the Earth looking for assets that exists at a low state of productivity waiting to be elevated to a higher state of productivity.

The entrepreneur must first be able to identify an asset as an asset. Next they need to identify the lower level of productivity and they need to be able to imagine the higher potential level of productivity. The entrepreneur must identify and manage some risk, perform leadership tasks; and as a result, elevate the asset to the higher state of productivity. Profit is the difference between the lower and the higher state – minus expenses.

Unfortunately, today this process starts at the forest and ends at the junkyard.

This is how our economic system is organized. The next economic paradigm flips that idea over. Instead of accounting for natural resources as the tangible element and human knowledge as the intangibles element; the next economic paradigm must account for the natural resource as the intangible element and the human knowledge as the tangible element.

The current problem is not that knowledge is intangible; rather, knowledge is simply invisible.

The Ingenesist Project will make knowledge assets visible by provisioning all of the information that an entrepreneur now needs to identify the knowledge asset and the associated states of productivity. Entrepreneurs can then increase human productivity using knowledge assets applied to natural resources, instead of natural resources applied to consumption. The implications are vast.

Returning to the financial analogy:

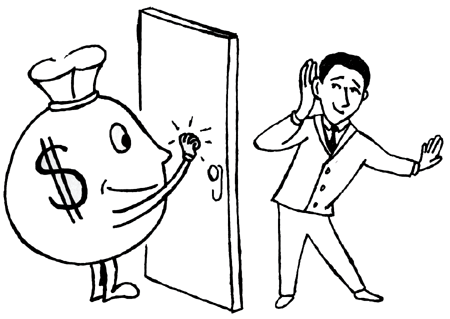

With a financial bank, the entrepreneur assumes that they have the knowledge required to execute a business plan and the go to the Financial Institution to borrow the money.

With an “Innovation Bank” the entrepreneur assumes that they have the money to execute the business plan, and they go to the innovation institution to borrow the knowledge.

While this may sound trivial, the implications are vast:

1. A virtuous circle now exists between society and the financial system

2. Profit is derived from increasing human productivity not natural resource exploitation.

Economics is the science of incentives:

A financial Bank seeks to match a surplus of money with a deficit of money. It is in the best interest of the bank to find rich people who will not need their money for a while, and poor people have the best likelihood of paying the money back in time. The process assumes that the borrower has the knowledge required to execute a business plan when they seek to borrow money. However, that FICO score does not measure knowledge explicitly, so little incentive exists to make it tangible. All of the top ten reasons why businesses fail are due to failures of knowledge. The financial system is collapsing under the weight of failed knowledge.

By contrast, the Innovation Bank seeks to find people who have a surplus of knowledge and people who have a deficit of knowledge about what they intend to produce. The innovation bank then uses a series of statistical calculus (the same calculus as the credit/insurance/risk management professions) to match most worthy surplus of knowledge assets to most worthy deficit of knowledge assets. Here, the opposite assumption is made; everyone assumes that the borrower has the money required to execute the business plan and they go to the innovation bank to borrow the knowledge. People have an incentive to accumulate knowledge.

Simplicity that defies comprehension:

The business plan for the new entrepreneur is deceptively simple to do and nearly impossible to monopolize; anyone can do it not just the wealthy and their chosen few. The next 3 modules will outline how new enterprises will be constructed from the virtuous circle created between the financial bank and the innovation bank. This changes everything …. and did I mention that the implications are vast?