Collateralized Debt Obligations (CDOs) are a type of structured asset-backed security (ABS) whose value and payments are derived from a portfolio of fixed-income underlying assets. In the case of the current financial crisis, the underlying assets were home mortgages. It is not necessary for the CDO buyer or seller to know who lives in the home and what they produce; the asset is a contract backed by future productivity.

CDOs vary in structure and underlying assets, but the basic principle is the same. To create a CDO, a corporate entity is constructed to hold contracts as collateral and to sell packages of predictable future cash flows to investors. The more money handed out in home loans, the more money could be collected in CDOs

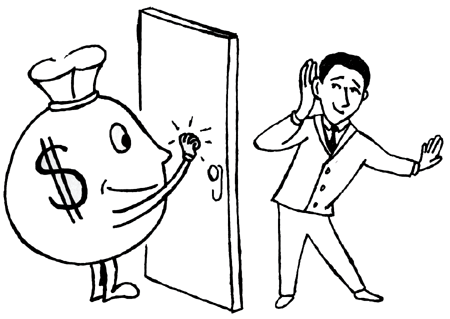

You are a liability.

While corporate leaders proclaim that people are the greatest asset, corporate accounting practices specify otherwise. Employees are an expense and their salaries, benefits, and pensions are liabilities to be reduced any time the opportunity arises. So what’s the problem? Liabilities can’t innovate.

Suppose for a moment that people were in fact an asset on the accounting sheet and their salaries, benefits, and pensions were “investments”.

Collateralized Innovation Obligation (CIO):

The CIO would obviously be a type of structured asset-backed security (ABS) whose value and payments are derived from a portfolio of fixed-income underlying assets, specifically, the output of productive and motivated people.

Like the CDO, a CIO would vary in structure and underlying assets, but the basic principle is the same. To create a CIO, a corporate entity is constructed to hold assets as collateral and to sell predicted future cash flows to investors. It is not necessary for the CIO buyer or seller to know who is innovating or what they are producing; the asset is a contract backed by future changes in productivity. The more money handed out in innovation loans, the more money could be collected in CIOs. For all practical purposes, we could call it an Innovation Bond.

Enter Social Media:

Social media is teaching us an important lesson about innovation. Every time you get a diverse group of people together to share ideas, new ideas form. Every idea is useful as long as it is shared; thousands of bad ideas must expire before the good one appears. Conversational currency is the vetting mechanism of all ideas. While not every good idea becomes a great invention, every great invention is built from good ideas. Machines cannot produce ideas and no single company, country or person holds a monopoly on ideas. Innovation and the creation of all wealth arise from the social, creative, and intellectual interaction of people.

Conversational Currency: The underlying asset

The underlying asset that supports both the Collateralized Debt Obligation and the Collateralized Innovation Obligation is a person and their ideas; one is an asset and the other is a liability. Both types of people go to work every day to interact with other people. They both share ideas and create better ways of doing things. People increase human productivity through fault tolerant networks and support systems. They transform information into knowledge and innovation – and both pay their mortgage.