The objective of this series is to contain what we know about social networks within the construct of the financial system. The intention is for knowledge to behave, and thereby trade like a financial instrument. In prior articles, we discovered the currency, the inventory, the institutions, and the entrepreneurs of the next economic paradigm. This module will construct the business plan:

A business plan is the blue print for the construction of enterprise.

Like the construction of any tangible asset, an inventory of parts is assembled in strategic proportions. The ability to accomplish this gives the enterprise a strategic and competitive advantage in a market.

Business failures are knowledge failures

Most enterprises will emphasize design, or service, or performance or price in their proprietary secret sauce of market success. The question becomes, what quantities and qualities of strategic components allow the new enterprise to create a positive economic outcome.

Most business failure are due to knowledge deficits such as the inexperienced management team, a poor assessment of market conditions, under estimating the amount of money needed, under estimating a competitor, loss of a key employee, or the poor understanding of the technology, etc. These are knowledge problems not financial problems.

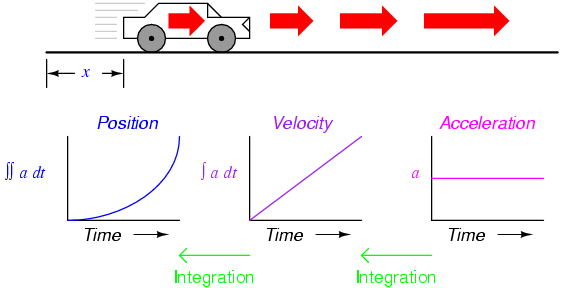

Prediction is the quality of knowledge:

To solve the knowledge problems is to decrease the risk of innovating and increase the predictability of innovations. To decrease the risk will decrease the cost, and increase the availability, of venture capital. To increase the predictability would increase entrepreneurial activity.

The Unit Business Plan:

The business plan of the innovation economy is very simple; it starts with the single transaction between two people. The lender provides information and the borrower combines the information with their existing knowledge to create more knowledge. This single transaction has a value of 1 unit of currency and we call it a unit business transaction:

The Parallel Circuit:

Now we will assemble these single transactions in many combinations. When we combine two unit transactions in a parallel circuit. This represents a brain storming session between two people.

The Percentile Search Engine matches the person with the most worthy knowledge supply to a person with the most worthy knowledge demand. The transaction is a simple conversation and the outcome is a prototype process, system, method, or iteration.

The Series Circuit:

The next transaction type is modeled as two unit business transactions occurring in a series circuit. This represents a product development cycle.

Each cycle of these transactions is an improvement to the business objective. Each time the transaction occurs there is a net increase of new knowledge and therefore an increase in value. New options are created. The conversation stops when the product is ready for the market, cancellation, or next physical iteration.

The transaction is recorded as an event between two known persons of known knowledge inventories. The transaction is stored in the intellect of the participants and becomes their property in the form of a knowledge asset represented by the things they create with their knowledge.

The Social Network:

Now if we combine the parallel transaction with the series transaction we have what now looks like a network. In practice, we know that strong networks of people freely exchanging ideas make organizations better, smarter, and more efficient. Networks are where knowledge and community wisdom is stored. A network is fault tolerant, if one person leaves, the network survives. For a relatively small input into a network, we can produce a large output of new knowledge – we have a learning organization.

However, in society, these interactions are largely accidental; people meet at Church, Starbucks, and Social Events or by word of mouth. Other times, these interactions are concentrated inside a single community of very similar people such as a technical conference, group meeting, or lunch buddies and are often not well diversified. More recently, interaction is self selecting through social media devices such as Twitter, Linkedin, Craigslist, Biznik, and Meetup, etc.

What if the social interactions could be made less random and more intentional?

Suppose interactions be designed with a specific purpose by the entrepreneur as a means toward producing a unique outcome. The Innovation Bank will combine people of complementary knowledge assets in a calculated manner in order to arrive at specific business approaches and applications.

What if Innovation could be made less random and more intentional?

The Multiplier Effect:

A special case business plan is called the Multiplier Effect. In effect, building a network of applications from a network of knowledge assets.

Suppose that a company owns composite material technology for use on aircraft. Since the company specializes in airplanes, they have no intention of pursuing other applications such as recreational equipment, energy production, or health care products.

The Innovation Bank:

Suppose that the company could deposit this asset in a bank and collect interest. The Search Engine can scan the business landscape to find persons or organizations with a worthy knowledge deficit in the area of your technology. The originator holds the option to see what those other companies invent and hold the right to use their new ideas in an aircraft application.

Contracts manage those options. Those contracts are social contracts and they can be traded. They are a form of currency – or stored value.

In the event of a cyclic downturn, instead of “laying off” knowledge assets, people can work in tangential industries where they will continue developing – literally putting “Knowledge in the Bank” – to be called back to their original company when market conditions improve. A mobile knowledge asset increases in value and continually becomes smarter and more productive over time. This is not socialism, this is not capitalism, this is Ingenesism – from the root word: Ingenuity.

Market Efficiencies:

With an innovation Bank, a company can reduce their Research and Development costs and create additional revenue in a tangential innovation market. Millions of people are being layed off work from corporations – billions upon billions of dollars of innovation potential is being squandered. With reduced cost and risk of innovation, The new American corporations will specialize in inventing, networking, and applying new ideas as their primary revenue source.